Home · Blog · Economics & Policy · · 7 min read

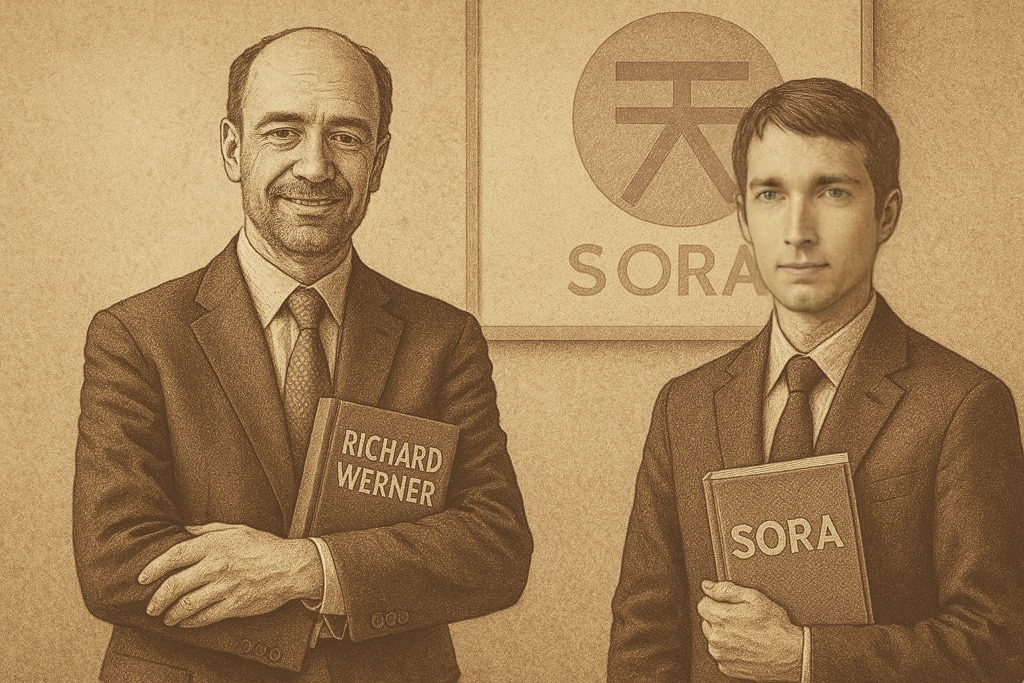

Richard Werner Exposes Central Banks & the SORA Alternative

Richard Werner reveals how central banks create crises. SORA responds with elastic money, democratic governance, and blockchain-based credit allocation.

TL;DR

In a nearly three-hour interview published by Tucker Carlson in July 2025, economist Richard Werner revisits three decades of research to show how modern central banks manufacture crises, underwrite wars, and quietly enrich insiders. The interview—part of Carlson’s independent journalism series—offers one of Werner’s most comprehensive critiques of the global monetary system to date.

Introduction

For decades, economist Richard Werner has sounded the alarm on the hidden architecture of the global financial system. Most famous for coining the term “quantitative easing,” Werner is also the author of Princes of the Yen, a book that exposed how Japan’s central bank helped orchestrate one of the largest asset bubbles in history.

In this interview published in July 2025, Werner goes even deeper—connecting central banking to everything from global conflict to covert intelligence operations. His central message is this: control over money creation means control over economies, governments, and ultimately, history.

Meanwhile, SORA—a decentralized blockchain network—has quietly been building a system that implements Werner’s economic ideas in code. With its elastic token supply, democratic governance structure, and focus on funding real-world productivity, SORA offers a living, breathing counter-model to the legacy financial system.

Central Banking’s Hidden Role in Crises

According to Werner, central banks are not the stabilizing institutions they claim to be. In reality, they often amplify financial instability. He explains how central banks like the Federal Reserve expand and contract the supply of money in ways that create artificial booms and devastating busts.

The 1920s stock market bubble and the 1930s Great Depression? Werner says both were Fed-induced. He describes how credit expansion—followed by sudden tightening—pulled the rug out from under the U.S. economy, triggering widespread unemployment and bankruptcies.

But the key insight isn’t just that crises happen—it’s how they happen. In Werner’s view, the root cause is the fact that banks can create money by issuing loans, often with little regulation and almost no transparency. This makes the financial sector the most powerful force in the economy, capable of driving prices, policy, and even public opinion.

The Structural Problem: Who Controls Credit?

Most people think banks lend out money that’s already been saved. Werner debunks this myth. Banks don’t lend existing money—they create new money the moment they issue a loan. This is the origin of most modern currency.

This insight has huge implications. If credit is allocated toward productive uses—like factories, infrastructure, or education—the economy grows sustainably. But if credit is funneled into speculation, housing bubbles, or government bailouts, the result is instability, inequality, and financial fragility.

In Werner’s words, the real battle isn’t over interest rates or inflation targets—it’s over who gets to allocate credit, and for what purpose.

Central Banks and the Machinery of War

One of the most provocative parts of the interview is Werner’s assertion that central banking and warfare are deeply linked. From the founding of the Bank of England in 1694 to the role of the Federal Reserve in World Wars I and II, history shows that the ability to create money has often been used to fund large-scale conflict.

When governments don’t have the public’s support—or the tax base—to pay for war, they turn to central banks. These banks print money, expand credit, and quietly finance military operations that would otherwise be politically impossible.

Werner also touches on darker aspects, such as covert intelligence funding and narcotics-linked banking operations, arguing that opaque monetary systems are fertile ground for hidden agendas. In short, where there’s unaccountable control over money, there’s power with no oversight.

The Case for Decentralization

For Werner, the solution is clear: decentralize the power to create and allocate money. He advocates for systems that empower communities, ensure transparency, and tie new money to productive—not speculative—uses.

This is where blockchain comes in. A decentralized, algorithmic system can prevent the kind of manipulative, behind-the-curtain decisions that dominate central banking. But not all blockchains are equal. A real alternative must go beyond speculation and meme coins. It must offer governance, utility, and macroeconomic logic.

This is exactly what SORA aims to provide.

What Is SORA?

SORA is a blockchain-based economic system designed to function as a supranational monetary order—an alternative to centralized financial systems dominated by state-run central banks. Its current infrastructure is powered by Substrate, but the upcoming SORA v3 will transition to a next-generation architecture based on Hyperledger Iroha, offering improved modularity, governance, and enterprise-grade stability.

SORA is built on three key pillars:

- XOR, its native token, whose supply is elastic and dynamically adjusted through a Token Bonding Curve that ensures algorithmic price discovery and liquidity.

- Democratic governance via a multi-body Parliament selected by random sortition, giving all network participants equal opportunity to influence decisions—without relying on wealth-based voting.

- Productive finance, where new XOR can only be created for projects that generate tangible economic value, such as education, infrastructure, or public goods.

- Polkaswap, a cross-chain decentralized exchange that enables trading between XOR and other assets, ensuring real utility and velocity within the ecosystem.

- Fast, low-cost transactions (~3 seconds finality with minimal fees), designed for practical use in day-to-day economic activity.

While most blockchain networks focus on DeFi speculation or Layer 2 scaling, SORA is focused on building a functional economy, complete with governance, monetary policy, and public finance mechanisms—all embedded in code.

How SORA Puts Werner’s Theories into Practice

SORA’s economic model is structured around the very ideas Richard Werner has promoted for decades.

1. Elastic Money Supply

SORA doesn’t fix XOR’s supply like Bitcoin. Instead, it uses a Token Bonding Curve, an on-chain algorithm that mints or burns XOR in exchange for reserve assets like DAI or ETH. This ensures that supply expands when demand rises and contracts when demand falls—helping stabilize price and liquidity.

2. Productive Use of Capital

Newly created XOR is not issued arbitrarily. It must be approved through SORA’s governance process and directed only toward projects that will generate real economic value—such as education, infrastructure, and innovation hubs. This mimics Werner’s concept of “productive credit.”

3. Democratic Monetary Governance

SORA’s Parliament is composed of citizens selected by sortition—a random lottery system inspired by Athenian democracy. This prevents plutocratic control and ensures that monetary policy is shaped by the community, not financial elites.

4. Integration with DeFi

Through platforms like Polkaswap, XOR has immediate liquidity and utility. It can be swapped cross-chain, used in liquidity pools, and integrated with algorithmic stablecoins. This creates velocity of money—an essential part of any functioning economy.

SORA vs Central Banking: A Comparison

| Feature | Central Banking | SORA |

|---|---|---|

| Money Creation | Controlled by elite committees | Algorithmic and community-driven |

| Transparency | Limited, often secretive | Fully transparent and on-chain |

| Credit Allocation | Often speculative or political | Only for productive, community-approved projects |

| Governance | Appointed technocrats | Citizens chosen by random draw |

| Inflation Control | Managed with blunt tools | Elastic supply + deflationary burn fees |

| War Financing | Historically linked | Structurally prohibited |

Werner’s Involvement in the SORA Ecosystem

Richard Werner is not just an intellectual inspiration for SORA—he has actively participated in its development. He delivered keynotes at both the 2021 and 2022 SORA Economic Forums, where he emphasized the need for decentralized economic models that avoid the pitfalls of central banking.

His work on the Disaggregated Quantity Theory of Credit—which emphasizes that the allocation of money is more important than the amount—directly influenced how SORA handles monetary expansion. New XOR must go toward productive purposes, not speculation.

Why SORA’s Approach Matters Now

SORA doesn’t just offer a different way to trade tokens—it offers a different vision for the global economy. At a time when inflation, war, and central bank overreach dominate headlines, systems like SORA present real alternatives.

For policy makers, SORA is a testbed for debt-free public finance.

For crypto builders, it shows that governance and utility matter more than hype.

For economists, it validates the idea that monetary architecture can be redesigned, and that such redesign is urgently needed.

Conclusion

Richard Werner has long argued that central banking is not just flawed—it’s structurally dangerous. By quietly controlling the creation and allocation of money, central banks influence every facet of modern life, from the price of food to the outbreak of war.

SORA offers a working model of what a post-central bank system could look like: algorithmic supply management, democratic governance, transparent funding, and a focus on real-world productivity. It is not a theory. It’s operational.

In Werner’s words, “We need to decentralize power.” SORA is doing just that—one block at a time.

Helpful Links

- SORA Project

- Polkaswap DEX

- SORA Wiki (Governance & Tokenomics)

- SORA Economic Forum

- Princes of the Yen (Book)

- Soranauts: Why SORA Matters

📘 Financial Disclaimer

This article is for educational and informational purposes only. It does not constitute financial, investment, or legal advice. Cryptocurrency investments carry risk and volatility. Always do your own research and consult with a licensed financial advisor before making financial decisions. The author and SORA ecosystem contributors are not responsible for any financial actions taken based on this content.

Financial Disclaimer

Financial Disclaimer: The information provided on Soranauts is for educational and informational purposes only and should not be taken as financial, investment, or trading advice. Content related to SORA, Polkaswap, TONSWAP, or other cryptocurrencies does not constitute investment recommendations. Cryptocurrency and DeFi investments are highly volatile and involve significant risk, including potential loss of capital, smart contract vulnerabilities, impermanent loss, and regulatory changes. Always conduct your own research (DYOR) and consult a qualified financial advisor before making any decisions. Past performance does not guarantee future results. Soranauts and its authors assume no responsibility for financial losses resulting from actions taken based on this information.